Mastering the Pocket Option Donchian Channels for Effective Trading

Mastering the Pocket Option Donchian Channels for Effective Trading

The Donchian Channels are a popular technical analysis tool that helps traders identify trends and potential breakout opportunities in financial markets. On platforms like Pocket Option, utilizing Donchian Channels can provide valuable insights, assisting traders in making informed decisions. In this article, we will delve into what Donchian Channels are, their significance, and how to effectively use them on Pocket Option to enhance your trading strategy. For a thorough understanding, you can refer to this guide: Pocket Option Donchian Channels https://trading-pocketoption.com/trendovyj-indikator-donchian-channels/.

What are Donchian Channels?

Donchian Channels were developed by Richard Donchian, who is often considered the father of trend following. The indicator comprises three lines: the upper line, the lower line, and the middle line. The upper line represents the highest price over a specified period, while the lower line represents the lowest price. The middle line is the average of the two. These channels help traders visualize the volatility of price movements and potential areas of support and resistance.

Why Use Donchian Channels?

One of the key advantages of using Donchian Channels is their simplicity and clarity. They help identify periods of consolidation and breakout trends, which are crucial for traders looking to capitalize on market movements. Additionally, the dynamic nature of the channels allows traders to adjust their strategies based on changing market conditions. Whether you are a beginner or a seasoned trader, utilizing Donchian Channels can add a valuable dimension to your trading toolkit.

How to Set Up Donchian Channels on Pocket Option

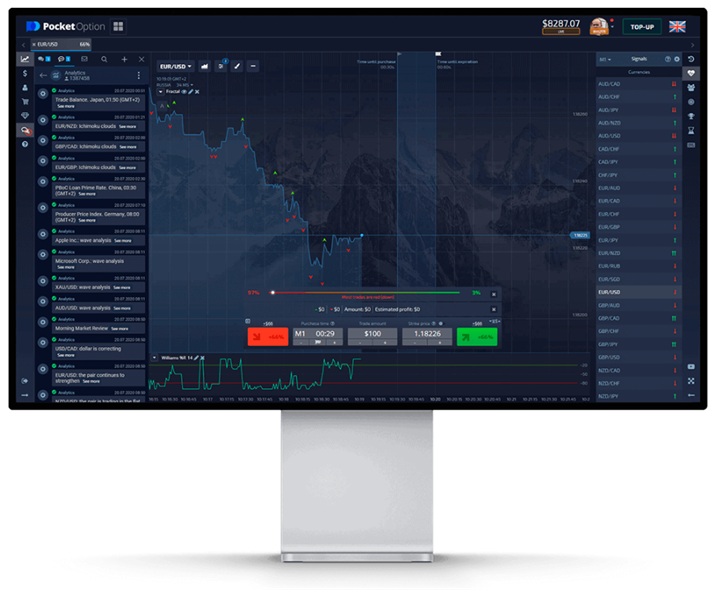

Setting up Donchian Channels on the Pocket Option platform is straightforward. Follow these steps to add the indicator to your trading chart:

- Log in to your Pocket Option account.

- Choose a trading asset and open the chart view.

- Click on the ‘Indicators’ tab on the right-hand side of the chart.

- Search for ‘Donchian Channels’ and select it from the list.

- Adjust the settings for the period you wish to analyze (common periods are 20 or 50 bars).

Once you have added the Donchian Channels to your chart, you will see the three lines representing the upper, middle, and lower bands. Pay close attention to these lines as they will be your guide for trading decisions.

Interpreting Donchian Channels

Understanding how to interpret the Donchian Channels is critical for successful trading. Here are some key points to consider:

- Breakouts: A breakout occurs when the price moves above the upper band or below the lower band. This can signal a potential trend continuation, and traders may consider entering trades in the direction of the breakout.

- Consolidation: When the price moves within the bands, it indicates a period of consolidation. This can be an opportunity to prepare for potential breakouts.

- Trend Reversal: If the price repeatedly tests the upper or lower bands without breaking out, it may indicate a trend reversal. Traders should be cautious and reassess their strategies in such scenarios.

Combining Donchian Channels with Other Indicators

While Donchian Channels are powerful on their own, they can be even more effective when combined with other technical indicators. Some popular indicators to pair with Donchian Channels include:

- Moving Averages: Using moving averages can help confirm trends identified by Donchian Channels and provide additional context before entering a trade.

- Relative Strength Index (RSI): The RSI can help gauge whether an asset is overbought or oversold, providing further insights when the price approaches the upper or lower bands.

- MACD: The Moving Average Convergence Divergence (MACD) indicator can help identify momentum and strengthen your signals when trading with Donchian Channels.

Risk Management Strategies

Effective risk management is essential for any trading strategy, and using Donchian Channels is no exception. Here are some risk management strategies to consider:

- Setting Stop-Loss Orders: Placing stop-loss orders just beyond the Donchian Channels can help protect your investment by limiting potential losses.

- Position Sizing: Adjust your position sizes based on your account balance and the volatility indicated by the Donchian Channels. This ensures that you are not overexposed to the market.

- Reviewing Trades: After closing trades, review your performance and learn from your experiences. Understanding what worked and what didn’t will help refine your future strategies.

Conclusion

The Pocket Option Donchian Channels are a powerful tool for traders looking to make informed decisions based on clear visual indicators of market trends. By understanding how to set up, interpret, and effectively use Donchian Channels, traders can enhance their strategies and improve their chances of success. Remember to incorporate sound risk management practices and consider using additional indicators to strengthen your trading approach. With practice and careful analysis, Donchian Channels can become a valuable part of your trading arsenal.